Credit Score 411

Understand How Your Score is Calculated & Why It Matters

Your credit score is the key to unlocking your purchasing power and building your financial future. As your score rises, more doors will open. But, how is your credit score determined and why isn’t it the same across the board? Our Credit Score 411 will provide the answers to all your questions!

What is a Credit Score?

Your credit score, sometimes referred to as a credit rating, is a three-digit number that gives lenders and others a quick snapshot of your credit history. In general, your credit score will fall between 300 and 850. The higher the score (670+), the more likely you will be approved for loans, credit cards, and other financial opportunities.

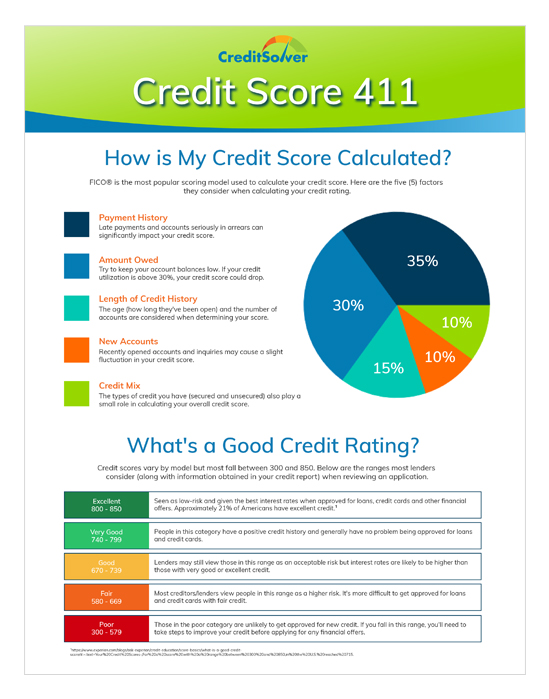

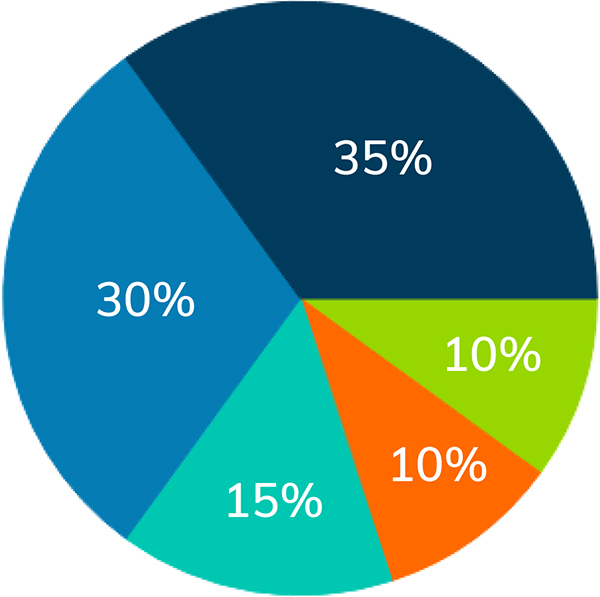

How is My Credit Score Calculated?

Although there are many different scoring models available, most look at the following five (5) factors when calculating your overall credit rating:

Payment History

Late payments and accounts seriously in arrears can significantly impact your credit score.

Amount Owed

Try to keep your account balances low. If your credit utilization is above 30%, your credit score could drop.

Length of Credit History

The age (how long they’ve been open) and the number of accounts are considered when determining your score.

New Accounts

Recently opened accounts and inquiries may cause a slight fluctuation in your credit score.

Credit Mix

The types of credit you have (secured and unsecured) also play a small role in calculating your overall credit score.

Is My FICO® Score The Same as My Credit Score?

FICO® is the most popular scoring model used to calculate your credit score. Most lenders use your FICO® when reviewing a credit application or loan request. Your FICO® score, however, may differ from your credit score at each of the three major credit bureaus (Equifax, Experian, and TransUnion). This is because each has its own proprietary scoring formula. Some services, such as Credit Karma, also use different scoring models (VantageScore®) to determine your score. Even with the varying models, your FICO® score and credit score should be very similar. If there is a large difference, you should review your credit report for errors or suspicious activity.

To learn more about your credit score, check out these blog posts:

- The Importance Of Establishing A Good Credit History

- 5 Expert Tips On How To Improve Your Credit Score

- Does Closing A Credit Card Impact My Credit Score?

Download our free Credit Score 411 guide now.